2023-01-16

According to the latest shipping market analysis and forecasts, shipping companies have lost control of the market and instead of actively managing their capacity, they have returned to the old way of "price wars" without changing their nature.

A few months ago, it was believed that shipping companies would take necessary measures to reduce their capacity before the shipping market got completely out of control; and it was believed that structural changes had taken place in the shipping industry and the consolidated shipping alliances would operate efficiently and help to get rid of the old habits of shipping companies (price wars), but in the latest forecast, it was found that the judgment was wrong.

Now, shipping companies will shift aggressively only in the case of severe losses. Earlier, when the shipping market started to show signs of weakness, shipping companies obeyed the ingrained instinct to secure short-term orders by cutting prices and securing cargo volumes, rather than controlling capacity. With the benefit of hindsight, shipping companies would have needed to take proactive measures at that time, rather than being exposed to external market forces and powerless now.

It's not that the shipping companies did nothing; they launched a lot of empty sailings, but they didn't take effect and spot rates continued to fall, rapidly approaching the five-year average prices during 2015-19. Today, it seems that record orders for 2021-22 (about 6.7 million TEU capacity) are very redundant after the bursting of the shipping market boom bubble.

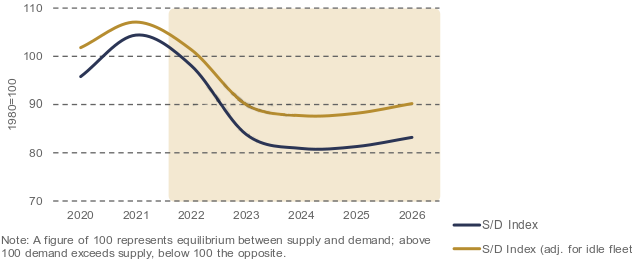

Global supply and demand curve, with curve values above 100 indicating oversupply and below 100 indicating oversupply

Capacity curtailment will result in a very low capacity growth rate of about 1.9% for the 2023 fleet, but supply chain congestion relief will free up a lot of capacity, resulting in an expected increase in effective capacity of about 19% and a return to an oversupplied market. As a result, ocean freight contract offers are now only a little compared to a year ago. It is observed that the proportion of idle fleet is only slightly higher than three months ago, dismantling of ships is just starting, and the current capacity reduction measures are not in effect, tracking the break-even points of three major routes through the following charts.

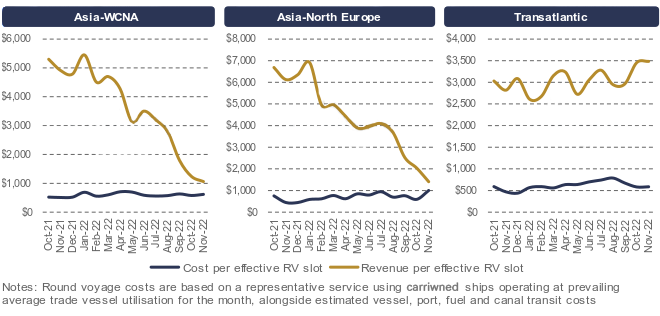

The blue line indicates the cost of the route and the yellow line indicates the revenue of the route in TEU/USD, from left to right for Asia-US West, Asia-North Europe and Transatlantic routes respectively.

The chart shows that the profit level of Asia-US West and Asia-North Europe routes are falling rapidly, but still profitable, so shipping companies lack the motivation to cut capacity drastically, however, if not hang on in time, these two routes will soon fall below the break-even point, on the other hand, the transatlantic routes are still very profitable.

This chart is like a doomsday clock, counting down the time when shipping companies are losing money. JIKEship believes that the convergence of the profit and loss lines of Asia-US West and Asia-North Europe will prompt shipping companies to take action, but shipping companies don't want to rush, they want to see if there will be a peak of orders in the window before Chinese New Year (from Jan 22), and at the same time they can also shift some capacity to transatlantic routes to make money.

As a result, JIKEship believes that given that cargo volumes are falling at an alarming rate and ocean freight rates are close to break-even, shipping lines will make significant capacity adjustments in 2023 to prevent freight rates from falling below break-even levels, rather than to keep margins above historical averages through effective capacity management.

It is estimated that in 2023, the consolidated operating profit of the container shipping industry will decline to $15 billion, only 5% of 2022 ($290 billion), and other consultants also expressed their views, Linerlytica said shipping companies were caught off guard by the opening year of 2023, and may experience losses this year; John McCown (quarterly liner company profit report producer John McCown (producer of the quarterly liner profit report) is relatively optimistic, he expects shipping companies to be profitable in 2023, and active capacity management will be the core factor for shipping companies to avoid financial deficits; Peter Sand, chief analyst of the shipping platform Xeneta, believes that what needs to be concerned is the idle fleet, Xeneta expects 25% of container ship orders to be deferred, and no more than 10% of orders to be cancelled (mainly executable orders), rather than costly outright cancellations. Peter Sand believes that shipping companies with more long-term agreements will remain profitable, while companies struggling in the spot market are already losing money and will continue to lose money in the next few months.

HSBC believes that inflation will continue the downward spiral of demand in 2023, and there will be a lot of capacity flooding into the market this year and next, which may trigger a new round of price wars; Maritime Strategies International, a UK-based maritime consultancy, said that the scrapping of old ships may increase this year, with scrapping capacity reaching around 270,000 TEU by the end of this year, with more growth in the following years. Xeneta expects to scrap 400,000 TEU of capacity, still short of the 2016 record (696,000 TEU.) MSI also says the scales have tipped significantly in favor of shippers, with some shippers not making large-scale contract commitments unless they get pre-epidemic rates, and that neither shipping lines nor shippers are getting what they want.

The port circle believes that the decline in cargo volume is obvious to all, and various consultants have different opinions, but the point of disagreement has been how shipping companies will respond to the predicament, or whether shipping companies can still maintain profitability. Mainstream views have once believed that alliance can make the liner industry out of the vicious cycle of cycles and price wars, but in a historically solid industry, the larger the volume of participants, but more difficult to get rid of industry inertia.

Entering global trade means that your responsibilities involve importing and exporting goods - which requires an understanding of Incoterms in logistics.

2023-01-13

We use third-party cookies in order to personalise your experience.

Read our cookie policy