2022-11-09

Are you planning to use international shipping to the UK? There are four separate ways to ship goods from China to the UK, which are courier, air freight, sea freight and rail. Of these, air freight, sea freight and courier are the more popular methods, with rail transport being used less frequently. In recent years, China has opened up the China-Europe train and more people are using rail transport.

JIKE Logistics a dedicated to making the service the best it can be, just for you wholeheartedly. We will provide you with freight quotes to find the best shipping rates from any city in China to the UK and much more. In this article we will introduce you to the various problems encountered in shipping to the UK and the advantages of shipping from China to the UK, we are sure you will benefit from this guide.

SUMMARY

Part 1.What are the modes of transport for goods from China to the UK

- International express to UK

- International air transport to the UK

- International shipping to the UK

- International rail to the UK

Part 2.Customs clearance in UK

- UK trade policy

- Tax policy on imported goods in UK

- How much duties and taxes will I pay ?

- What materials does The UK need for customs clearance?

- How long does it take for customs clearance in UK?

- The goods were detained, how is it?

- Prohibited & restricted items

Part 3.Additional shipping services

- China Storage Services

- Packing/unpacking services

Before shipping internationally to the UK, you need to be well prepared, for example, to arrange a perfect transport trip for your goods, and it is important that you choose a good UK transport method.

Then we'll get your UK transport moving without a hitch!

You can use the four major express DHL, Fedex, UPS, TNT and Postal Express EMS to mail items to the UK.

The disadvantage is that the timeframe is slow, normally it takes 7-15 days, no requirement for timeliness, and the price is affordable, and the mail has more sensitive goods such as food, powder, display, and chassis, you can choose to take EMS for mailing. Railway, the price is more affordable, but the time limit will be longer, normally 45-55 working days

What do I need to pay attention to when sending domestic courier to the UK?

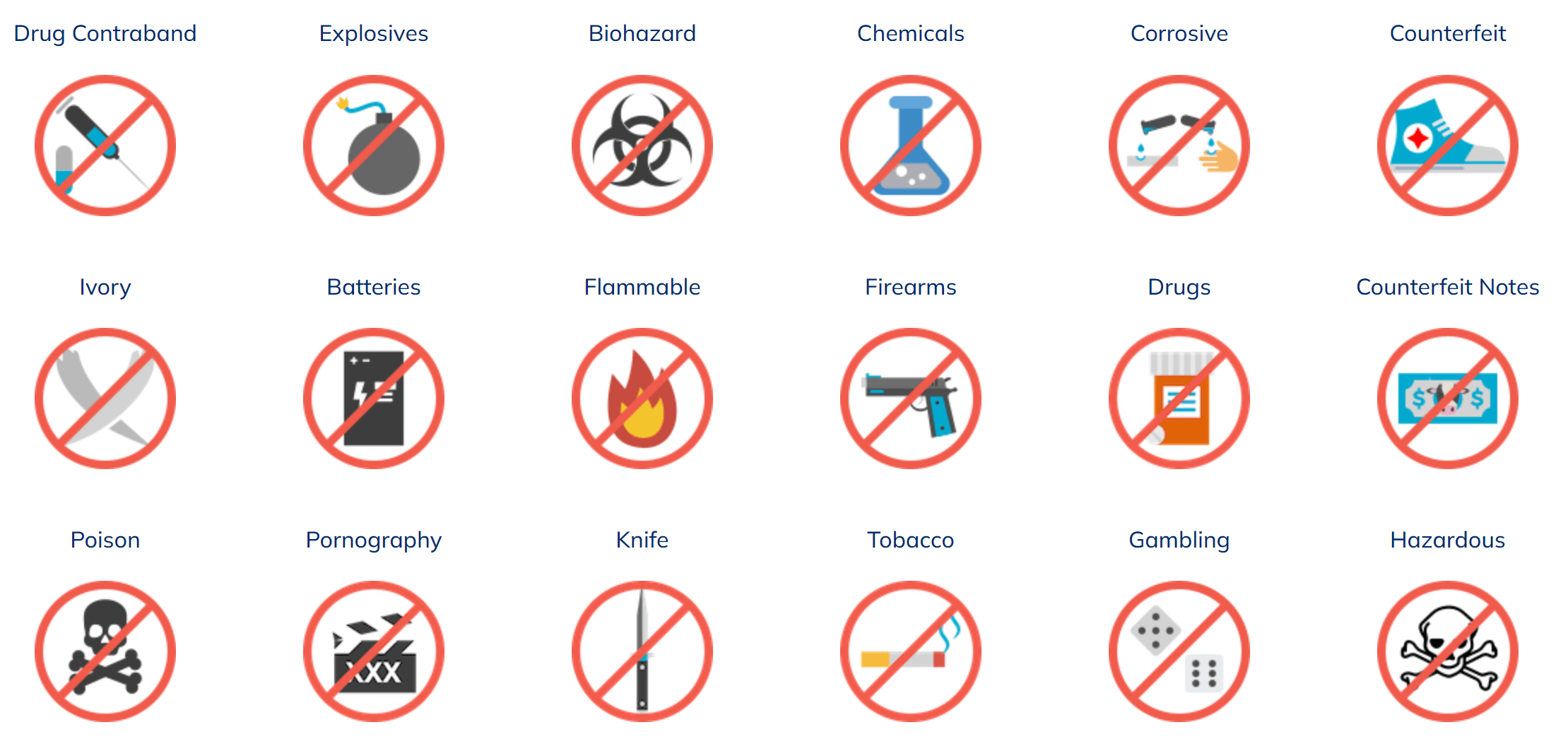

1.The posting of goods must be legal, in line with the requirements of the destination customs, flammable and explosive dangerous goods and prohibited goods are not allowed to be mailed.

2.International express will calculate the volume weight, reasonable use of the volume space of the package, try to avoid leaving empty and irregular packaging, can help us save a lot of freight.

3.Mailing fragile and leaky items is best to do a good job of sealing treatment before sending, adding foam bags and other appropriate protection to prevent damage to goods.

We offer airfreight services from Guangzhou, Shenzhen and Hong Kong airports. With our staff's rich export experience and good cooperation with various airlines such as EK, CA, EY, MH, AF, QR, etc., we can operate air cargo from various airports to all over the world and ensure that the cargo reaches its destination on time and safely.

Airfreight operation process

1.Booking: The sender fills in the BOOKING document (our company has a template) and submits it to our company, then our company submits the document to the shipping company, which will arrange the space according to the cargo size, weight, destination and other information.

2.Inbound: arrange inbound according to the inbound manifest given by the shipping company.

3.Customs declaration: (provide information before the goods are put into the warehouse), our company is responsible for customs declaration data entry, help export customs declaration.

4.Checking the information of bill of lading, after the goods are in the warehouse, the shipping company will issue accurate data and bill of lading according to the data.

5.arrange for insurance according to the cargo owner's requirements.

6.Track the cargo transportation process and provide timely feedback to the cargo owner on the latest developments.

Cargo weight calculation method

1.The unit of calculation is the kilogram. If the weight is less than 1 kg, it will be counted as 1 kg, with a minimum billing weight of 45 kg.

2.Volume of goods = length (cm) x width (cm) x height (cm) of goods ÷ 6000 = volume weight

3.volumetric weight = volume of goods (m3) x 167kg x total number of pieces of goods

4.Actual weight = physical weight of the goods after weighing

5.Chargeable weight = the greater of the volumetric weight and the actual weight compared to the weight of the goods, which is used to calculate the uk transport costs.

6.Heavy goods: the actual weight of the goods is greater than the volumetric weight

7.cast-off cargo: the actual weight of the goods is less than the volumetric weight

There is no doubt that sea freight is cheaper than other modes of transport, but it is cheaper than air freight and rail. In particular, sea freight to the UK is not directly accessible by rail because of the Channel, and the so-called rail transport on the market is also transited from other countries. Therefore, sea freight is undoubtedly the best way to send large shipments to the UK.

The billing unit for sea freight

As you all know, sea freight is charged by volume, i.e. per cubic metre. He does not look at the weight, does not look at the size, only at the amount of space you take up in the container, that is, the length times the width times the height. In principle, as long as the weight of a single piece of cargo does not exceed 5 tons, the longest side length does not exceed 3 meters, the goods can be packed into the container, the sea transport is possible.

About the time limit

Sea freight to the UK usually takes about 24 days to reach the UK port from the day after sailing. Note that this is only the time to the port, because after the ship arrives at the port, the container still needs to be unloaded from the ship, and then the goods also need to be pulled out of the container, which also takes time, about 1-2 days. In addition, in the case of typhoons and tsunamis, it is normal for the voyage to be delayed by a few days, which is after all an unavoidable factor!

When the ship arrives at the destination port, after unloading and unpacking, it needs to be cleared and delivered to your home, this process also takes time, normally about a week. Of course, if you just send the goods to the port, then do not care about this time, customs clearance to the terminal warehouse to pick up the goods on it.

About shipping costs

The cost is a key concern for many of you, as the shipping cost of goods can only be confirmed depending on the details of the goods and the address to the door. However, I have put together a good list of costs for your reference. However, I would like to explain it in different situations.

1, if the customer only wants to do the transport to the port, the latter part of the customs clearance and pick-up of his own arrangements.

Then according to the current mode of sea freight consolidation, the port of departure fee is relatively small, only need to pay a customs declaration fee and document fee can be, about 450 RMB. In other words, you only need to pay 450 RMB to the freight forwarder and he can send the goods to the UK port for you. However, there is no doubt that the consignee will also have to pay when he picks up the goods. 450 RMB is certainly not enough for the shipping costs, it is just put on the consignee's side to pay for the shipping costs, which can also be understood as freight on delivery. The breakdown of this cost is quite extensive, I have collated it and it adds up to £138 per cubic metre + £120. The cost is from the time the goods are received at the warehouse on the Chinese side of the freight forwarder to the time the goods are delivered to the UK terminal warehouse. It includes everything from the so-called warehouse rental, loading and unloading, towing, customs clearance and so on. It can also be understood that all costs from the receipt of the goods by the freight forwarder to the port to port.

2, If the customer wants to do sea freight door to door transport, after he hands over his goods to you, you are responsible for the whole process and send his goods to his receiving address.

In this case, the above costs will need to be added to the customs clearance and truck delivery fees. The total cost from door to door is: 450 RMB + 138 GBP per cubic metre + 120 GBP + customs clearance fee + truck delivery fee, the customs clearance fee is about 95 GBP, which is a fixed fee, and the truck delivery fee, which can only be quoted depending on the volume and address of the goods. This delivery charge can also be estimated if you have some knowledge of the local towing charges in the UK. As far as I know, a typical truck delivery charge for a 10 cubic metre shipment is around a few hundred pounds, ranging from 300 to a few hundred, depending on the proximity of the receiving address to the terminal warehouse.

Railway transport from China to the UK, although the UK is one of the big countries in Europe, but from the map you can see that the UK is located in the east of Europe and other countries separated by a channel, the railway to the UK needs to pass through a bridge, so the railway to the UK has very strict requirements for the weight of goods, not suitable for the transport of goods to the UK, so the China-Europe train does not provide direct rail transport to the UK for the time being. If you need Chinese rail transport to the UK, you can only use trucks from other countries to transit through. peak logistics season.

①The UK's Department of Trade is open to the outside world, or internationalisation, and is responsible for promoting and guiding the import and export of UK products and services, attracting overseas investors to the UK, developing relevant policies and financial support measures, and leading negotiations on foreign trade and investment arrangements.

②The UK Department for International Trade (DIT) has the primary responsibility for issuing export licences for specific local products that meet the requirements. Examples include safety equipment, certain chemicals, metals and engineering materials, machine tools, electronic components and other products.

③Imports and exports of animals, animal products and embryos require a health certificate issued by a veterinarian appointed by the UK Department for Environment, Food and Rural Affairs.

④If you export to the UK without CE marking (also known as safety certification), there is a high risk of being detained and investigated by customs. This type of certification is mainly for electronic and mechanical products to prevent safety hazards. The "CE" mark is a safety certification mark that is considered a passport opened by the manufacturer and entering the UK market.

⑤The UK will offer preferential rates for countries that have signed trade agreements and will issue licences for agricultural products, plants, furs, textiles, unprocessed diamonds, scrap etc.

①Imported products are subject to import taxes, which are all calculated based on the value of the shipment, i.e. CIF

②Uk tariffs range between 0% and 17%, and laptops, mobile phones, digital cameras and console consoles are exempt from tariffs

③The UK standard VAT rate is 20%, VAT = VAT rate × (CIF price + import duties)

④There is a starting point for import duty in the UK, with imports of goods up to £135 in value (FOH5) or £9 in total duty being exempt from duty and imports of goods up to £15 in value (FOH5) being exempt from VAT.

In all international trade, the first thing you need to do is determine the commodity code of your product. This string of numbers is known as the HS code and consists of a combination of six numbers that, like names, represent the designation referring to each product.

| JIKE tips : |

|---|

| If you are unsure of the HS code of your shipment, we recommend that you find the corresponding HS code through the official government website, or you can also find out by asking your supplier |

| The UK government have a great online tool to determine the HS code of your items, if you still don’t know it. Go to the product code search page and search for and identify the HS code that belongs to your product based on its characteristics, classification, material, etc. |

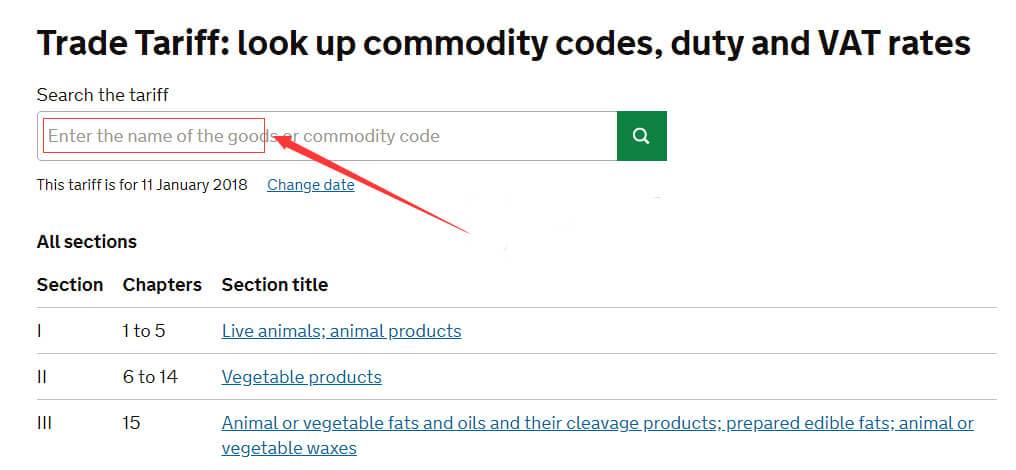

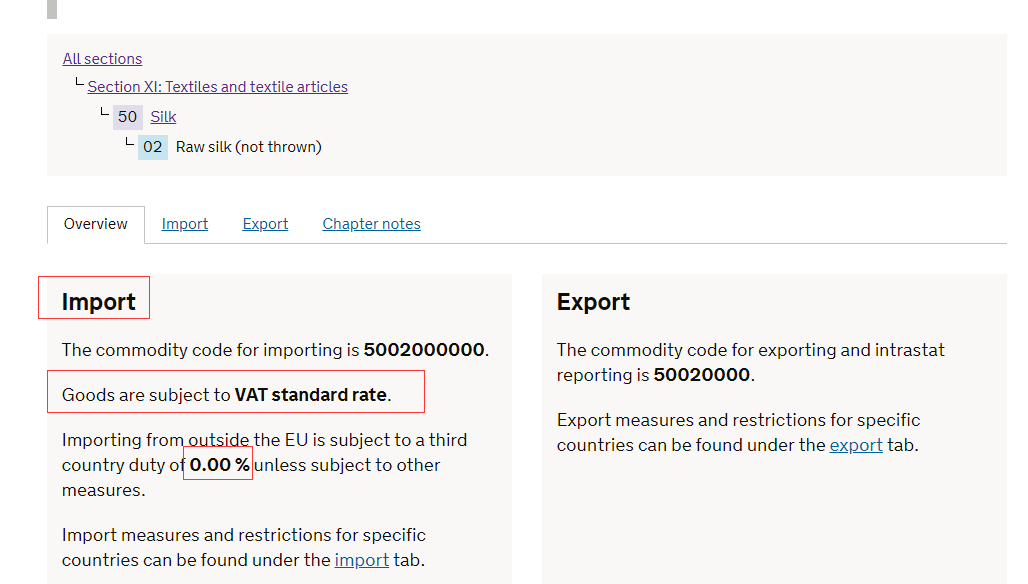

①Please see the UK government's tariff website gov.uk for details

②Click the Start now button

③Enter the product name or product code in the search box

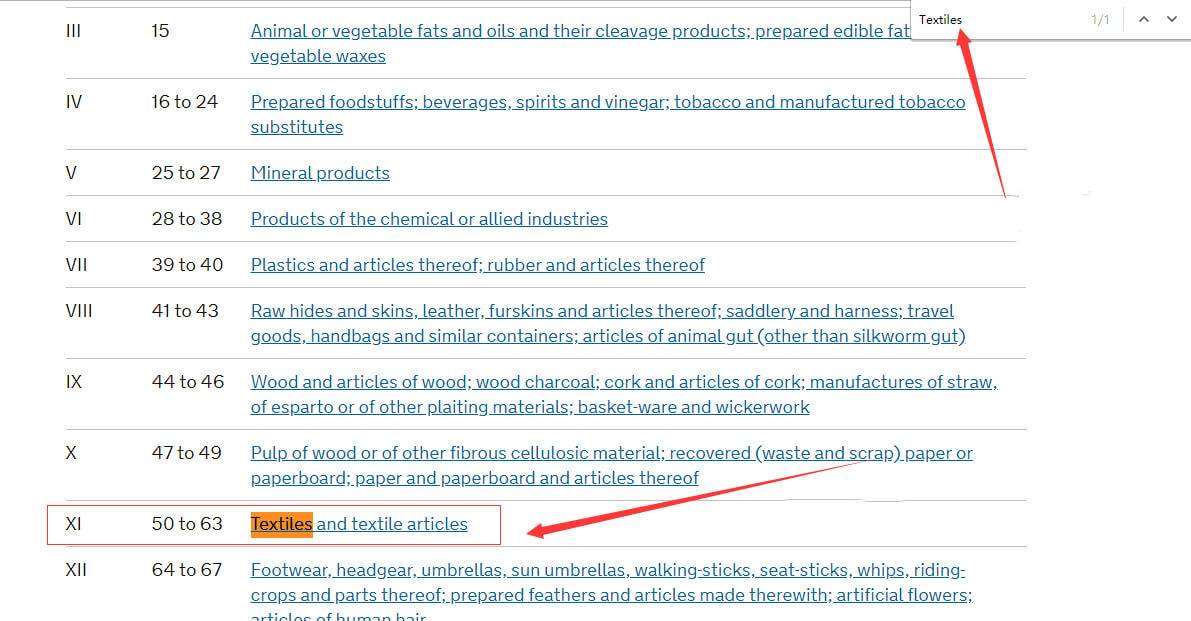

④For example, if I want to find tariffs on textiles/silk/raw silk, enter the corresponding product in the input box:

Step 1: Search for the part of the textile:

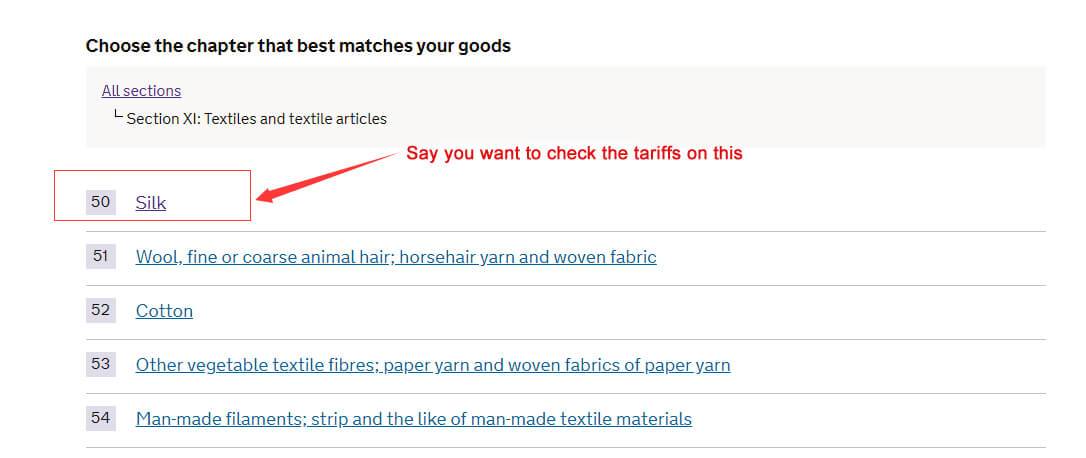

Step 2: Click silk

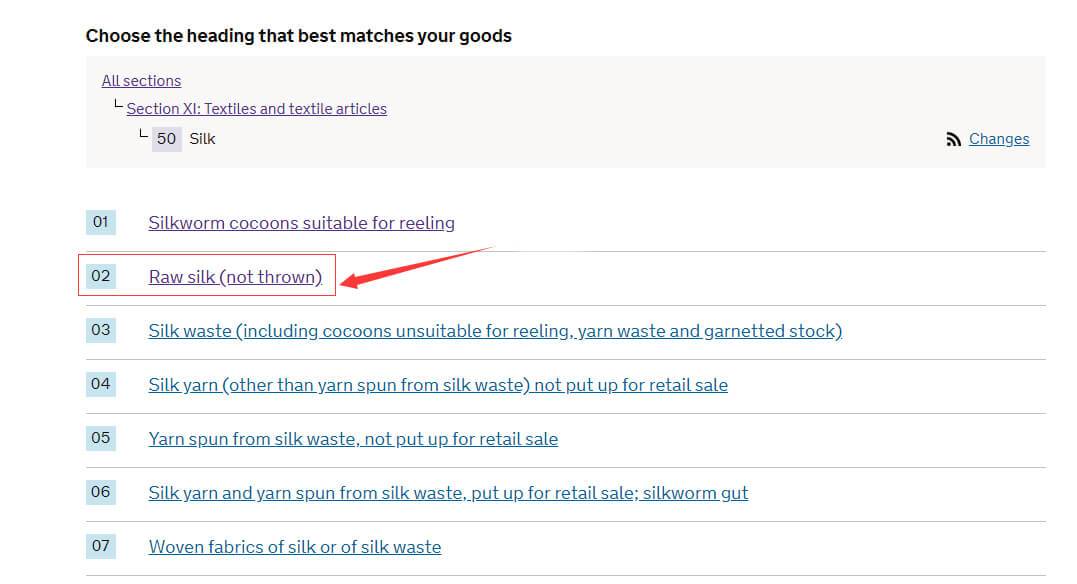

Step 3: Click raw silk

Step 4: The query results are displayed as follows

Raw silk import duties from countries outside the EU are: 0.00%.

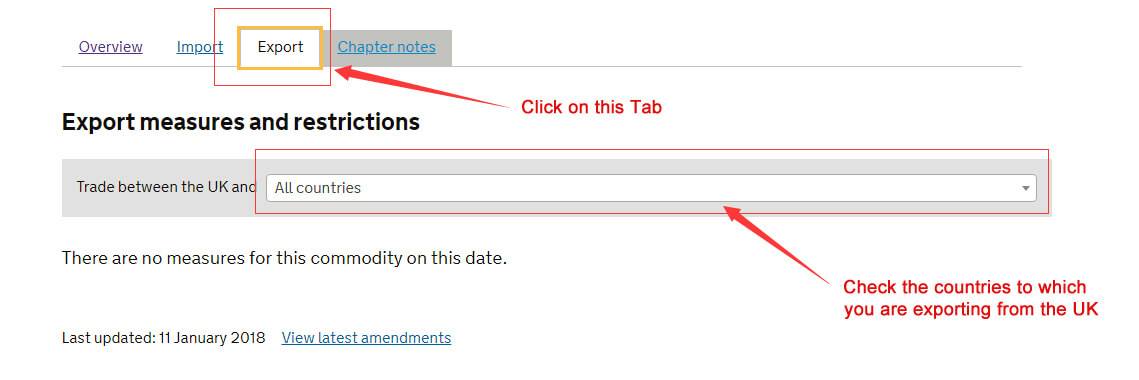

To check which goods can be imported directly into the UK duty free, follow the above method, click on the page that shows the results and an export tab will appear, click on it and do as shown in the screenshot below:

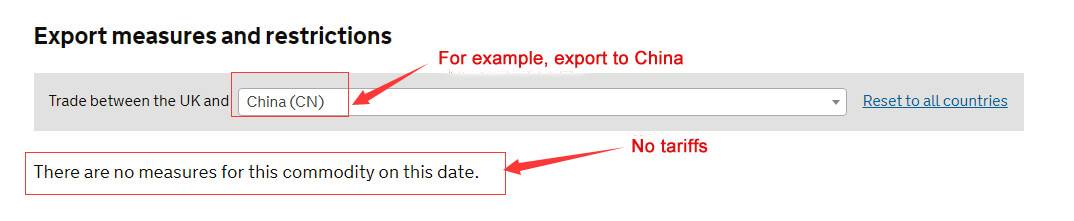

As the screenshot below shows, raw silk is exported from the UK to China and is shown as not subject to duty.

Customs clearance anywhere, not just in the UK, places great importance on customs clearance documentation as a basis for ensuring smooth customs clearance of export goods.

The customs clearance information is as follows:

Declaration form for export goods

Consignment note

A copy of the invoice

One copy of trade contract

Verification of foreign exchange receipt

All kinds of documents involved in customs supervision conditions

Certain special products will require some product certification or a certificate of origin, which we can give you upon request. One more thing is to ask whether you need to have the original stamped or the copy stamped.

Goods within the UK customs clearance usually takes regarding 3-5 days, the slowest isn't over twelve days, otherwise it should be that your merchandise are detained, you should to seek out a freight forwarding company to check the way to solve.

When a general parcel arrives at customs, the customs declaration of the goods needs to be approved, as well as the identity verification clearance of personal belongings; for some larger parcels, or suspicious parcels, an opening inspection will be carried out to confirm that the parcel is correct before it is released for passage.

It ought to even be noted that customs imposes a limit on the time for the consigner or his agent to declare customs clearance. The time limit for customs clearance for export goods is 24 hours before loading. Goods that do not require taxation fees and inspection shall be completed within 1 day from the date of acceptance of the declaration.

In general, the main reasons why goods are inspected and seized at UK Customs are:

The declared value and valuation are inconsistent, low declaration

The product name and the goods are inconsistent

Lack of relevant certifications, such as FDA Bluetooth, etc

Therefore, the name, quantity, value, etc. must be entered truthfully. of the goods according to the requirements to avoid being deducted.

Before departure, we are going to store the products within the warehouse in China. we've got warehouses in each major city in China so your product will be hold on nearer to the supplier's workplace. All our warehouses ar designed and maintained to store your product within the best condition

Would you like to find out more about our warehousing services? Check directly our dedicated page: Storage services.

The best security measures to safeguard your merchandise from any ultimate harm, that the packaging of your merchandise should be fastidiously thought of and handled fastidiously. If you wish to solve it yourself, we'll offer you some skilled recommendation. Our packaging team is absolutely skilled and absolutely packages all of your merchandise, notwithstanding what sort of package.

You want additional data regarding our packing services ? Check directly our dedicated page:Packing service

| FAQ |

|---|

| Q: How long does it take to ship my cargo from China to UK? |

| A:Even though most companies do not give you an exact date for the arrival of your cargo, they do provide an approximate date.In most cases these dates are reliable.But yet again it depends on the method of shipment and the frequency of the shipping company to your destination. |

| Q:My supplier has no right to export. Can you help me export the goods? |

| A: Yes, we can. We can buy the export license, do the customs declarationand ship the goods out to you. |

We use third-party cookies in order to personalise your experience.

Read our cookie policy