2022-12-14

Is your e-commerce business ready to expand into international shipping?

International trade is a tool for expanding our market for goods and services that might not otherwise be available. However, international trade is a very complex process that requires many documents and codes for classification. This is a very important step in the whole import and export process, so let's read the information about the HS code (Harmonized System code).

The HS Code (or HTS Code), also known as the Harmonized Commodity Description and Coding System, is a standardized international system for classifying products in global trade. The Harmonized System code is a standardized numerical method for classifying traded products that is used by customs authorities around the world to identify products, assess duties and taxes and collect statistics.

The Harmonized System code was first implemented in 1988 and was developed and administered by the World Customs Organization. The HS Convention was signed in 1983 and has over 200 member countries. As signatories, each country has agreed to classify its tariffs and duty structures according to the HS code categories.

The main features of the HS Code

- Consists of 5,000 commodity groups covering 99 chapters and containing 21 sections

- Identified by a six-digit code, which can be divided into three parts

- Supported by clearly defined rules with a legal and logical structure to achieve a globally harmonized classification

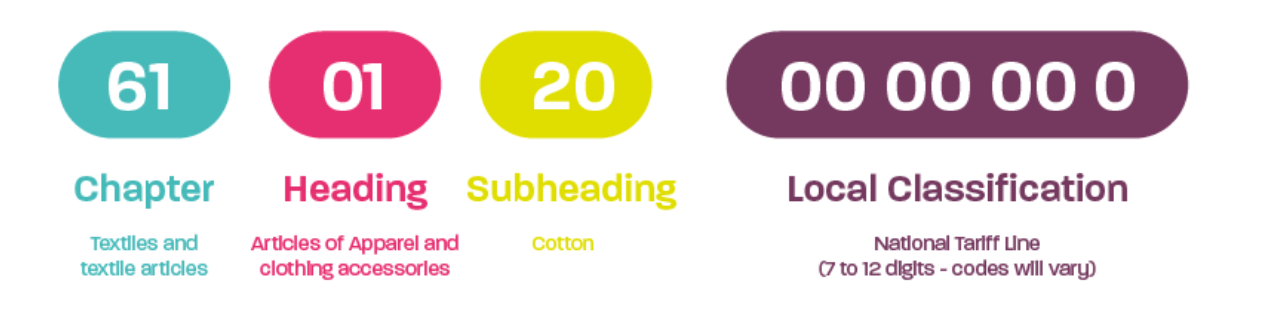

The HS code is a 6-digit code representing chapters, headings and subheadings which together define the goods to be imported/exported.

Analysis of HS codes:

The first two digits in the HS code are the section - this is the broad classification of your item. In our example, this would be textiles and textile articles (61)

The next two digits are the headings, which provide another layer of separation. In this case, we would need the Apparel & Clothing Accessories heading (01)

The last two digits are the subheading - it provides a final layer of clarification. In our textiles example, there is a subheading specific to material - Cotton, which adds the last two digits (20).

Combining all these components together gives the HS code: 610120. Note that there are times when a subheading is not required, in these cases the last two digits are 00.

HS code is the common economic language and code for goods and an indispensable tool for international trade, which is incorporated into more than 200 national and customs clearance systems worldwide. The HS code is an integral part of the process if goods are to reach their final destination uninterrupted after being correctly identified and classified by customs.

Note that the use of incorrect codes may be considered by customs as non-compliant, misleading or incorrectly declared - all of which come with associated penalties that can multiply the customer's transport costs.

The HS code system can be used to identify over 200,000 kinds of products, which means that finding the correct code can feel like searching for a needle in a haystack.

To assign the correct classification, you should determine what you need to know and the type of information required for the product. Each country has different import duty rates, so it is important that you consult a professional before importing.

If you need help with the classification of your products (HS code search), the best and easiest way is for you to contact your freight forwarder or customs broker.

Note: If the exporting and importing countries currently have a free trade agreement, the exporter can provide the importer with a certificate of origin, which can reduce or eliminate import duty charges.

Since the establishment of the HS codes in 1988, the WCO has updated the HS codes every five years to reflect these changes. With each change, some HS codes have been removed and the definitions of other HS codes have changed - some definitions have been expanded to include more commodities.

The changes to the HS system came into effect globally on 1 November 2022 - with all 211 countries included in the update. There are many changes in the latest HS code update, over 300 amendments in fact, and 12% of all EU codes are affected in some form.

Note: From 1 November 2022, all shipments must use the 6-digit HS code and shipping instructions will be rejected if not received. Please enter the 6-digit HS code in the dedicated field.

As you can see, the HS code is a very important tool and is necessary for every shipping process, so having it at your fingertips is key to ease of transport.

We're excited to share what we've learned with you. By reading this article, we are sure you already know a lot about HS codes and if you have a clear understanding of your goods, you can act now.

You can also feel free to ask for help from JIKEship for more information or questions. We hope we have answered all your questions about HS codes.

Are you curious about how import duties and taxes are calculated? Then, JIKEship takes you to step by step to understand duties and taxes.

2022-11-24

We use third-party cookies in order to personalise your experience.

Read our cookie policy