2023-01-12

After the last week of 2022, container shipping rates fell sharply again in the first week of the new year. Facing the double pressure of low demand and capacity growth, the container shipping market in 2023 may enter a sustained recession "Great Depression".

According to the latest data released by the Shanghai Shipping Exchange on January 6, last week the Shanghai Export Container Freight Index (SCFI) fell 46.41 points to 1061.14 points, from the last week of last year, a small increase of 0.04% to a decline, and the decline expanded to 4.19%, beyond container shipping market expectations, the main ocean shipping routes in addition to the Mediterranean line rates are down.

Last week, the Far East to Europe line per TEU rate fell 28 U.S. dollars to 1,050 U.S. dollars, a weekly decline of 2.5%. Far East to the Mediterranean line per TEU rates rose by $5 to $1,855, up 0.27% week-on-week. The Far East to the U.S. West line per FEU rate fell $9 to $1,414, down 0.63% week-on-week. The Far East to the U.S. East line per FEU rate fell $222 per week to $2,845, down 7.2 percent.

Analysts said that the SCFI index on New Year's Eve a single week reported 1107.55 points, a weekly increase of 0.04%, after 27 consecutive weeks of decline for the first time, but the first week of the New Year and again stopped falling, including the largest drop of 7.2% in the U.S. East line rates. The U.S. West line has been a loss, the U.S. East line and continued to plunge, the U.S. line in May long contract for the contract to bring a big impact. On the other hand, the European line, which is currently under negotiation for a long contract, saw a 2.5% drop in freight rates, showing that the consolidation company's attempt to raise spot rates for a higher price for the contract has failed.

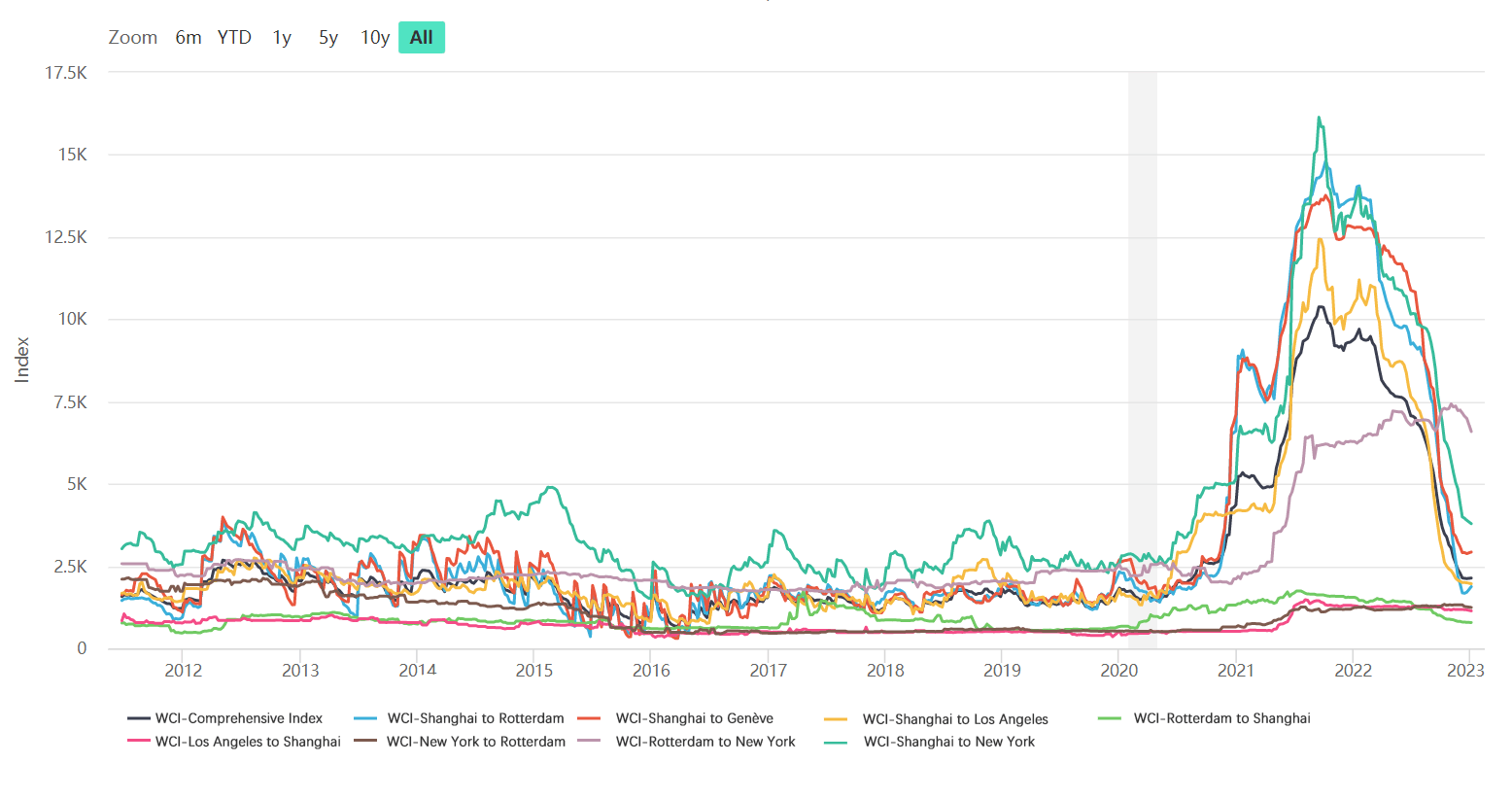

Meanwhile, the World Container Freight Index (WCI) compiled by shipping consultancy Drewry showed that the WCI index ended 42 consecutive weeks of decline and rose 0.7% as of Jan. 5, but fell 77% compared with the same period last year. Shanghai to the U.S. West is still down 1%, and Shanghai to the U.S. East is down 3%. Nonetheless, Drewry expects a slight downward adjustment in freight rates in the coming weeks.

Industry sources pointed out that the weak international economic climate, the ongoing trade war between the U.S. and China and the war between Russia and Ukraine, coupled with the time needed for manufacturers to digest their inventories, resulted in weak demand for international shipping and an overall decline in Far East to global cargo volumes. Many shipping companies for the Spring Festival holiday and off-season plans after the year, began to accumulate ballast goods, kill the price of grabbing goods to dump boxes.

Among them, the U.S. East line is still profitable, attracting consolidation companies to continue to invest, coupled with the U.S. West line freight prices fell deep, many of the ships originally transferred from the U.S. West line to the U.S. East line recently began to return, are the reasons for the U.S. East line plunge; Persian Gulf, Australia / New Zealand, West Africa, South America and other routes, more non-alliance ships, more intense price grabbing goods.

At present, a large number of container ships have been suspended in succession. The latest statistics show that by the volume of reduced global inactive container ship capacity accounted for 5.5% by the end of 2022, reaching 261, of which 93 idle capacity, the world's largest container shipping company Mediterranean Shipping idle ships up to 23. This situation will be more obvious in the first quarter of this year, with more slowdowns and class reductions.

Due to the high uncertainty in the container shipping market, the first half of this year's market conditions are uncertain, a number of shipping companies predict that the first quarter of the container shipping market may be relatively light, with the U.S. inventory consumption, inflation and energy prices to ease, coupled with the expected economic policy adjustments in major countries, the second quarter demand may slowly become better, looking forward to the third quarter price and volume can rebound.

In its latest cargo forecast report, Drewry pointed out that the fleet growth rate in 2023 is relatively low, at 1.9%. The easing of supply chain congestion will increase effective capacity by 19%, returning the container shipping market to a state of oversupply. Current capacity reduction measures have yet to materialize, with the proportion of the idle fleet only slightly higher than three months ago and shipbreaking just beginning.

The severe supply chain disruptions and container traffic congestion during the epidemic have changed in the recent past. The outlook for trade growth will be extremely challenging at least through the first half of 2023 due to excess inventories and pressure on consumer disposable income.

Spot rates fell sharply in the second half of 2022 and are now well below contract rates, with data from Xeneta showing signs that contract rates are also starting to decline. One of the major issues facing shipping companies today is the impact of falling freight rates on profitability.

Drewry pointed out that although the profitability of the Asia-US-West and Asia-North Europe routes is rapidly declining, but carriers can still be profitable, resulting in insufficient power to cut capacity. But if capacity management is not strengthened, the cost of the route will soon exceed revenue, relative to the transatlantic round-trip route revenue is still much higher than the cost, becoming the most profitable east-west route.

As different routes will perform differently in the coming quarters, the Asia-US route may come under pressure sooner. It is expected that by mid-year, the overall outlook should be optimistic and the profitability situation will move towards a normal state, without dropping to the ultra-low profit level before the epidemic.

For consolidators, the quickest way to defend freight rates is to spontaneously scale back capacity. The next two years, new ship deliveries soared, 2023 new capacity 2.4 million TEU, 2024 more to 2.8 million TEU, oversupply will be the norm. At present, the global container ship fleet capacity of 26.4 million TEU, but more than 25 years old for the demolition of the old ship proportion of only 3%, so the next 2 years, the container shipping industry will continue to be in serious oversupply. The expansion of speed reduction, class reduction and ship dismantling by major global consolidation companies will effectively shrink the capacity.

Ryan Petersen, founder of Flexport, a maritime logistics technology company, said that the current average loading of container shipping is only 70%. A large number of ships have already started to slow down, which cuts capacity by 4-6 percent. But in the medium-term perspective, this capacity cut is just a drop in the bucket, stimulated by the shipping boom after the epidemic, shipping companies ordered a large number of ships. Container capacity will grow by 25% over the next three years as new ships come on stream, which will lead to a serious overcapacity. Combined with the slowdown in freight demand due to the economic slowdown, the entire shipping industry is in a "recession".

Petersen believes that the length and depth of the current shipping recession depends on a variety of factors, including the direction of the Chinese economy and the financial health of U.S. consumers.

Barclays analyst Alexia Doagani believes that shipping rates will not stabilize until after the global economy improves, the current de-stocking cycle ends, and consumer behavior returns to normal. Until then, consolidators will still have to work hard to negotiate with customers and maintain the value of their long-term contracts.

Analysts at shipping consultancy Maritime Strategies International (MSI) point out that three factors will be quite important to the container shipping outlook in 2023: trade growth, fleet growth rate and size, and management of congestion and capacity. It will exceed the average growth rate in 2025. If scrapping is not high, the fleet will grow by as much as 10% per year.

MSI's latest quarterly container shipping market report concluded that the entire container shipping sector may fall into a downturn in 2023 and may continue into 2024.

Are you annoyed by the unexplained over-pricing of every shipment? Shipping container weight limits are part of the reason, so find out more.

2022-12-15

We use third-party cookies in order to personalise your experience.

Read our cookie policy